IBM agreed to acquire software maker Red Hat Inc. in a $33.4 billion bet on jump-starting its efforts to catch up in the cloud.

International Business Machines Corp. will pay $190 a share in cash for Raleigh, North Carolina-based Red Hat, according to a statement from the companies Sunday, confirming an earlier Bloomberg News report. That’s a 63 percent premium over Red Hat’s closing price of $116.68 per share on Friday.

“The acquisition of Red Hat is a game-changer. It changes everything about the cloud market,” said Ginni Rometty, IBM’s chairman and chief executive officer, in the statement.

Rometty, 61, has been trying for years to steer the 107-year-old technology giant toward more modern businesses, such as the cloud, artificial intelligence and security software.

In its third-quarter results, IBM disappointed investors who were seeking more progress in those areas after six years of declining sales that had only started to show gains earlier this year. The improvements had been coming largely from IBM’s legacy mainframe business, rather than its so-called strategic imperatives.

The Red Hat purchase will give IBM an immediate cloud revenue boost growth as well as a suite of proven software products to sell through its global sales force.

“We will scale what Red Hat has deeply into many more enterprises than they’re able to get to,” Rometty said in a phone interview.

Revenue at Red Hat, which sells software and services based on the open source Linux operating system, is expected to top $3 billion for the first time this year as the company’s Red Hat Enterprise Linux product attracts business from large customers. Last quarter the company reported a record 11 contracts valued at over $5 million each and 73 over $1 million, according to a note from JMP Securities analyst Greg McDowell.

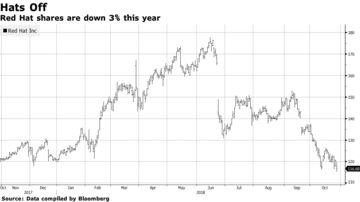

At the same time, sales last quarter overall missed analysts’ expectations and the forecast for the current quarter also fell short, fueling concerns Red Hat may be losing deals to rivals and growth may be slowing. The company said at the time it believes the slowdown has “bottomed out.” Red Hat’s stock is down 28 percent over the past six months through Friday, according to data compiled by Bloomberg.

IBM, which has a market valuation of $114 billion, has seen revenue decline by almost a quarter since Rometty took the CEO role in 2012. While some of that has been from divestitures, most is from declining sales in existing hardware, software and services offerings, as the company has struggled to compete with younger technology companies.

Rometty said IBM “paid a very fair price. This is a premium company. If you look underneath, this is strong revenue growth, strong profit strong free cash flow“ she said.

IBM will continue to grow its dividend and neither company will cut jobs after the deal, Rometty said.

“This is an acquisition for revenue growth, this is not for cost synergies” she said.

Red Hat makes IBM “a credible player in cloud now — both private and hybrid cloud,” Bloomberg Intelligence analyst Anurag Rana said. “This gives them an asset that looks forward and not backwards.”

Goldman Sachs Group Inc. and JPMorgan Chase & Co. advised IBM on the deal and provided financing.

“Knowing first-hand how important open, hybrid cloud technologies are to helping businesses unlock value, we see the power of bringing these two companies together,” JPMorgan CEO Jamie Dimon said in an emailed statement.